When it comes to securing home financing, homebuyers are in search of aggressive rates and an excellent streamlined processes. In this quest for the best financial, you’ve probably came across Costco Real estate loan. Exactly what precisely is it, which is they the best choice for your home financing demands?

Which full book delves into the ins and outs regarding Costco Mortgage loan, investigating the possess, advantages, cons, and responding some frequently asked questions. Our aim is to try to permit you to the knowledge making told choices about your home loan excursion.

What is actually Costco Home mortgage?

As opposed to precisely what the term might highly recommend, Costco doesn’t individually promote mortgages. Alternatively, Costco Real estate loan operates once the a recommendation system. This choice connects Costco professionals having a choose system out of reliable mortgage brokers. Essentially, Costco provides partnered with lots of loan providers to incorporate the members having the means to access potentially discount financial prices and you may settlement costs.

How does Costco Mortgage loan Functions?

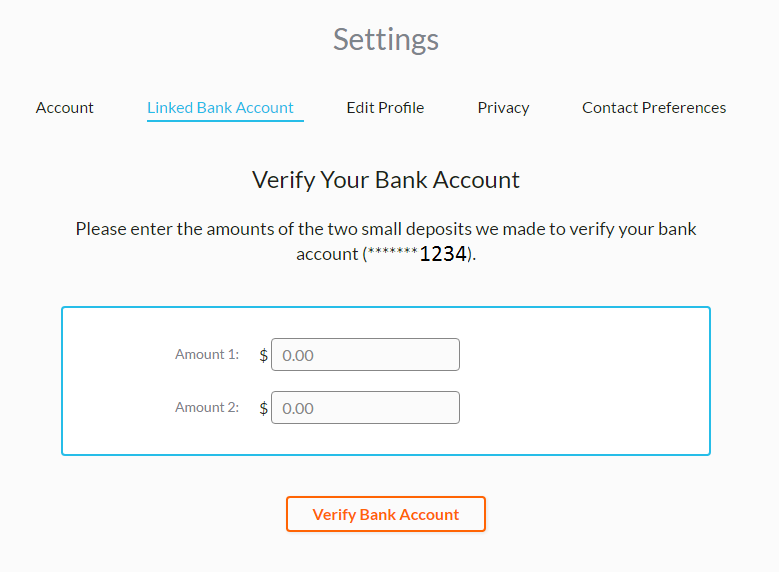

On line Software: Visit the Costco Mortgage webpages and over an on-line app. Which app requires information about your debts, need loan amount, together with property you want to buy otherwise re-finance.

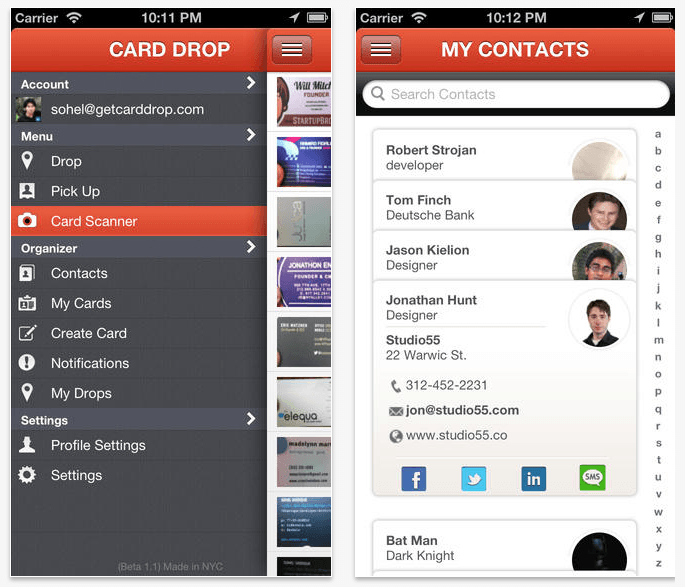

Lender Options: After you have filed your application, you’re getting quotes of multiple lenders within this Costco’s community. Such rates have a tendency to details interest rates, mortgage terms, and settlement costs, enabling you to examine also offers top-by-front.

Choosing a loan provider: Cautiously opinion new prices and pick the financial institution you to definitely most readily useful aligns with your monetary specifications and you may tastes. Costco brings units and you can information in order to examine lenders effortlessly.

Loan Running: Once going for a loan provider, you’ll loans in Chester Center be able to performs myself with them doing the loan app procedure. This can include getting needed documentation, for example income confirmation, credit history, and you will possessions appraisals.

Closing: Once your loan is eligible and all new papers is signed, you’ll be able to move on to closure. This is where you are able to indication the final mortgage data files and you may technically safe the home loan.

Potential Advantages of choosing Costco Mortgage loan

Closing Savings: Costco members is eligible for deals otherwise credits toward closing costs, possibly preserving all of them numerous or even thousands of dollars.

Legitimate Lenders: Costco partners with well-established and you can legitimate lenders, offering participants peace of mind knowing he or she is dealing with leading creditors.

Potential Disadvantages to consider

Perhaps not Secured Deals: Whenever you are Costco is designed to secure competitive prices and you can closing costs, discounts aren’t protected. It certainly is best if you shop around and you will contrast even offers off their loan providers outside of the Costco circle.

Frequently asked questions on the Costco Home mortgage

- Traditional finance

- FHA money

- Virtual assistant financing

- Jumbo money

- Re-finance fund

For each and every lender when you look at the Costco community features its own particular eligibility criteria, together with credit history standards, debt-to-income ratio restrictions, and down payment minimums. You can aquire pre-qualified which have loan providers to choose the eligibility rather than affecting their borrowing from the bank score.

Zero, Costco doesn’t always have accessibility the intricate economic suggestions. When you fill out your internet app, its distributed to the lenders you choose to located estimates out of.

Sure, the fresh new Costco Real estate loan system are used for each other to shop for an alternate home and refinancing an existing financial. Refinancing courtesy Costco may potentially help you safe a diminished appeal rate, reduce your loan title, otherwise switch out of a changeable-rate mortgage to a predetermined-rate home loan.

Navigating The Financial Possibilities

Costco Real estate loan should be a valuable capital having Costco people, offering potential savings on the interest rates and closing costs. The handiness of researching numerous financial rates under one roof are an additional benefit. However, it’s required to remember that coupons are not guaranteed, and you can exploring solutions beyond Costco’s network is essential to possess protecting the latest most beneficial home loan conditions.

Before carefully deciding, very carefully consider your financial predicament, long-label specifications, and you may examine now offers from certain supply. Remember that knowledge are energy regarding while making advised economic possibilities.

Leave a Comment