Precisely what does brand new 2024 Compliant Loan Limitation Boost Suggest having Homebuyers?

With the , the brand new Government Homes Money Institution (FHFA) established new conforming loan restriction (CLL) increase within the 2024 from $726,2 hundred to $766,550. This is exactly a growth of five.56% or $forty,350 off 2023. If you are intending to buy otherwise refinance a property during the 2024, this information talks about just what conforming finance are and you can exactly what the brand new limits you’ll suggest to you.

What is actually a compliant Financing?

A compliant mortgage try home financing one to falls in loan limit numbers place of the FHFA therefore the underwriting recommendations mainly based from the Fannie mae and you will Freddie Mac, one or two government paid people (GSEs). For many borrowers, compliant financing would be easier to and get and less costly than simply nonconforming financing but generally need:

- The very least credit score out of 620

- 43% debt-to-income-proportion

- 3% advance payment

- Two-12 months reputation of work/income

Why are the elevated Compliant Financing Constraints the best thing?

Just like the price of house continued to increase this past year, homebuyers and home owners in search of a mortgage one to exceeds the latest 2023 conforming mortgage maximum ($726,200) could be compelled to and acquire a far more expensive, non-compliant jumbo loan such as for example. Brand new 2024 CLL increase makes it easier for those homebuyers so you can be eligible for a more high priced home with the conforming mortgage solution nevertheless up for grabs.

How was Compliant Financing Limit Expands Computed?

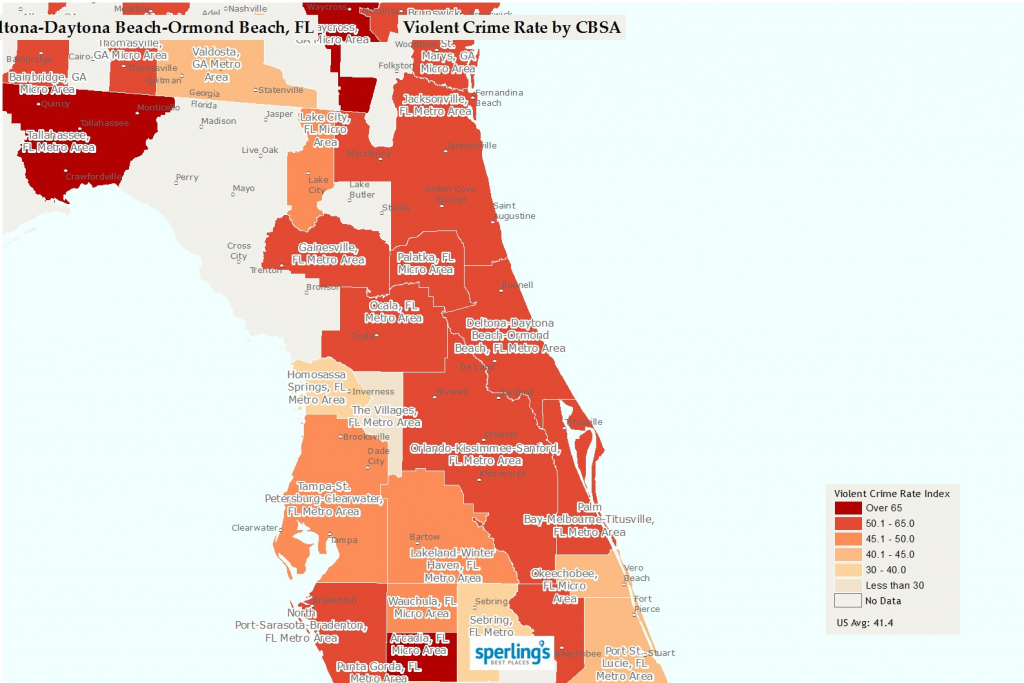

The fresh new Casing and you can Economic Recovery Operate (HERA) need FHFA to regulate compliant loan constraints read what he said annually so you can reflect the alteration throughout the mediocre You.S. home rate. With regards to the latest FHF?A house Rates Directory (FHFA HPI), home values improved because of the normally 5.56%, anywhere between Q3 2022 and you may Q3 2023. Ergo, the new limitations in 2024 will increase because of the exact same percentage. As the brand new restrict away from $766,550 relates to most of the All of us, it is critical to notice the true dollars number may vary when the you reside a high cost of living town. So it chart suggests the genuine constraints for each condition.

What’s the Difference between a traditional Mortgage and you will a conforming Mortgage?

A conventional loan is actually an interest rate protected by an exclusive lender, like your bank, and you may receives no federal support, in general perform that have a keen FHA financing, Va financing or USDA loan. When antique loans slide in the limitations lay by the FHFA and you will satisfy particular underwriting advice, he’s thought conforming and can afterwards getting ended up selling to help you Fannie mae or Freddie Mac computer. Which an advantage to financial institutions since it lets them to boost its resource supply alot more finance so you’re able to to increase your customer base.

What makes Here Constraints so you’re able to Conforming Financing?

Constraints are ready to own compliant loans with the intention that Federal national mortgage association and you may Freddie Mac can suffice more finance companies and homeowners across the country. Both organizations love to funds a high level of quicker mortgage loans than a smaller number of large mortgage loans.

What if I want a home loan Along the Conforming Maximum?

When you find yourself shopping for a home loan for the 2024 you to definitely exceeds $766,550, you can find available options. Very financial institutions provide jumbo finance, that are a variety of real estate loan you to definitely is higher than new compliant limitations. Although not, they frequently have more stringent degree guidance so guarantee talk about which have that loan officer to choose the best mortgage loan sorts of for your requirements.

- At least credit score out of 700

- 45% debt-to-income-proportion

- 10-20% advance payment or even more

- Potentially high interest rates

- Large analysis of borrowing from the bank and you will money history

The latest 2024 Conforming Loan Restriction boost means a lot more to invest in stamina having licensed homeowners looking to purchase otherwise refinance a property for the 2024. For those who have questions about brand new restrictions and other financial need, an FNBO Real estate loan Manager might help.

Leave a Comment